The IRS recently came out with its list of inflation related adjustments to tax brackets, standard deductions, phaseout thresholds and 401(k) contribution limits. Here are some important new limits to know. Planning and saving for your retirement has never been more important. If you are older than 50 years of age, pay close attention!

If you are jumping right to 2023 tax and financial planning without wrapping up 2022, take a minute to check out our guide to 2022 End of Year Financial Planning.

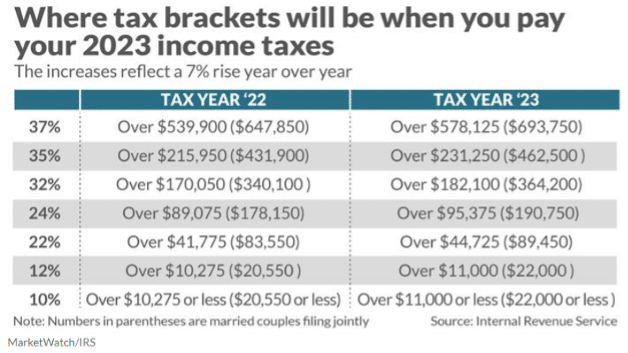

1. Tax Brackets for 2023 adjusted upwards for inflation reflect a 7% rise year over year.

The chart below outlines the comparison:

2. Increased standard deduction. It will automatically exempt $27,700 MFJ and $13,850 Individual of income.

It may be harder for some to itemize since mortgage interest and charitable contributions may provide less tax benefit. Tax planning may be more important than ever for some filers.

3. Workplace and IRA contribution limits increased across the board, as well as increased eligibility phaseout thresholds:

- HSA Limits:

- Single $3,850

- Family $7,750

- +$1,000 catch-up for those older than age 55

- IRA/IRA Roth Limits:

- $6,500 +1,000 catch-up for those older than age 50

- 401(k)/403(b)/457/SARSEPS Elective Deferral Limits:

- $22,500 +7,500 catch-up for those older than age 50

- Phaseouts: Single taxpayer covered by a workplace plan $73,000 – $83,000

- Phaseout: MCFJ where the spouse making the IRA contribution is covered by a workplace retirement plan $116,000- $136,000

- Phaseout: For an IRA saver without a workplace plan but their spouse is covered by an employer plan $218,000 – $228,000

Let us know if you have any questions or would like to talk about how this information specifically impacts your financial plan. Give any one of us a call at 513-733-1750.